Tax Brackets | Explained

- Taylor Perry

- Apr 9, 2020

- 2 min read

Updated: Dec 4, 2020

The United States adheres to a progressive taxation model, imposing lower tax rates on lower-income earners; as incomes rise, tax rates rise accordingly. This means that individuals with higher incomes are responsible for paying a larger portion of their income in taxes.

The United States structures its taxation system into a series of tax brackets. A tax bracket is a specified range of income subject to a certain tax rate, called a marginal tax rate. The higher the range of income, the higher the marginal tax rate.

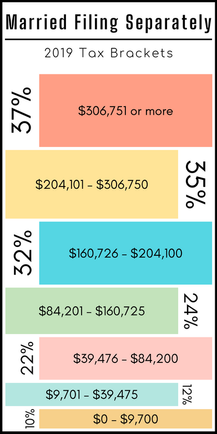

There are seven federal tax brackets in the United States, ranging from 10% to 37%. Because the dollar amount for each range varies based on filing status, there are effectively 28 distinct tax brackets.

Contrary to popular belief, your income is not taxed at a single rate determined by your tax bracket.

Instead, your income is divided into chunks according to each tax bracket, with each portion of income taxed at its corresponding rate.

In essence, you are taxed at multiple rates as your income rises.

If you are a single individual who made $100,000 of taxable income in 2019, you would fall into the 4th tax bracket. Your income would therefore be taxed at four different rates.

The first $9,700 of your income would be taxed at 10%.

This totals $970.

Your income from $9,701 to $39,475 would be taxed at 12%.

$39,475 - $9,701 = $29,774.

12% of $29,774 is $3,572.88.

The next portion of your income, between $39,476 and $84,200, would be taxed at 22%.

$84,200 - $39,476 = $44,724.

22% of $44, 724 is $9,839.28.

The remainder of your income would be taxed at 24%.

$100,000 - $84,201 = $15,799.

24% of $15,799 is $3,791.76.

By adding together the amount of income taxed at each bracket, we find the total amount of tax owed.

$970 + $3,572.88 + $9,839.28 + $3,791.76 = $18,173.92.

The total amount of income tax you owe reflects your effective tax rate, which is the percentage of your total income that you actually pay in taxes. You can calculate your effective tax rate by dividing your total tax owed by your taxable income.

Effective Tax Rate (ETR) = Total Tax ÷ Taxable Income

$18,173.92 ÷ $100,000 = 0.18

In our example, the effective tax rate comes out to 18%. This is significantly lower than the 24% marginal tax rate applied to the fourth tax bracket.

Compared to your marginal tax rate, your effective tax rate more accurately depicts what percentage of your income you actually pay in taxes.

Contact your local CPA for more answers to your questions this tax season. Subscribe below to stay up to date with our blog, Accounting Demystified.